Where big bank ability meets with small bank agility.

As a community business bank, we're able to offer that perfect blend of attentive, flexible service with modern products, exceptional standards, and innovative delivery that larger banks lack. We welcome the opportunity to discuss your financial goals and banking needs, from business loans to cash management services to hard working deposit accounts designed to save you money. You will see how our personalized service and local decision-making strengthens our ability to serve you.

Small Business Loans

We have options to help expand your business, upgrade equipment or purchase a commercial building.

Checking & Saving Plans

Our convenient, accessible accounts are designed to keep you in charge of your money - and your business.

Personalized Service

Our employees are innovative, creative, and empowered to ensure our customers have the best experience.

Bill Pay

At the office or on the go, paying bills is quick, easy and convenient with our Bill Pay service.

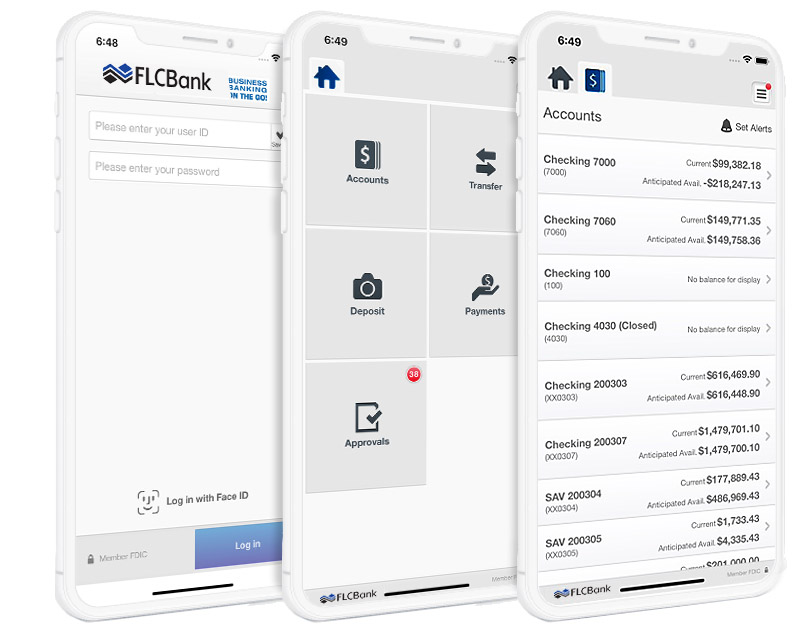

Business Banking on the Go

With the FLCBank Business Mobility App you can complete all of your transactions just as you would online with the same level of security that you have with our Online Banking.

- Check business account balances

- Move funds between FLCB accounts

- View monthly cash flow

- Deposit checks with mobile capture

- Review and approve transactions